INPUT YOUR DETAILS AND SEE HOW YOUR INVESTMENT GROWS!

Summary

Year-by-Year Growth

| Year | Balance | Contributions | Interest |

|---|

Growth Visualization

Compound Interest Calculator, Maximize Your Financial Growth

Discover how compound interest can accelerate your financial growth with our advanced calculator. Whether you’re planning for retirement, saving for a home, or building an emergency fund, understanding how compound returns work is key to making smarter investment decisions.

With this compound interest calculator, visualize your money’s future and see how even small contributions grow significantly over time. Perfect for anyone looking to boost their investment returns and create a solid savings plan.

Why Compound Interest Matters

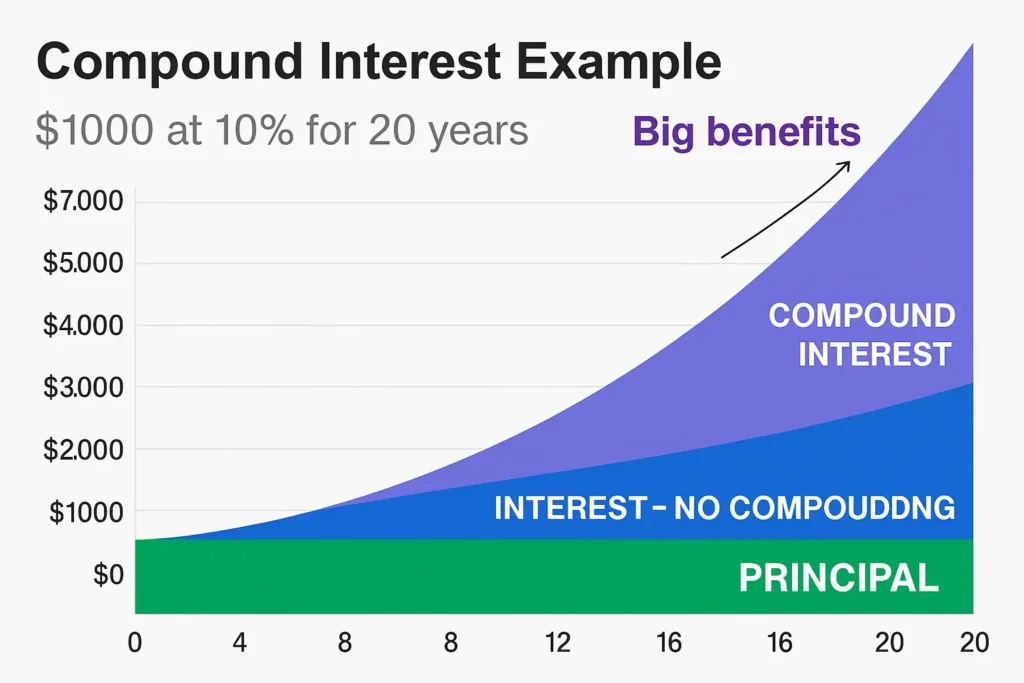

The Power of Compounding

Compound interest means you earn interest not just on your initial deposit, but also on the accumulated interest over time. This snowball effect is what makes it one of the most powerful tools in wealth building.

Investing $10,000 at a fixed 5% annual interest rate, compounded yearly, will grow to $26,532.98 over 20 years. That’s a total interest gain of $16,532.98, resulting in a 165% return on your original investment.

Key Benefits

Accelerates long-term wealth building through exponential growth

Beats inflation when optimized over long periods

Maximizes returns with regular contributions and reinvestment

How to Use Our Compound Interest Calculator

Step-by-Step Guide

Initial Deposit

Start by entering your current savings or lump-sum investment.Interest Rate

Input your expected annual return. For instance, long-term stock market averages are around 7%.Regular Contributions

Add recurring weekly, monthly, or yearly deposits to supercharge your compound returns.Time Horizon

Longer periods yield greater returns thanks to compounding. A few extra years can make a big difference.

Pro Tips

Adjust for inflation to understand your investment’s real value

Try different scenarios (e.g., compare 5% vs. 7% interest)

Use the tax rate field for a more realistic projection of after-tax gains

Compound Interest FAQs

1. How often should interest compound?

Monthly or daily compounding typically yields higher returns than annual compounding. Our calculator allows you to test different compounding frequencies to see what works best.

2. Can compound interest make me a millionaire?

Yes! With consistency and time, even modest savings can grow exponentially. Try entering $500/month at 8% for 30 years—you’ll be amazed.

3. What’s the difference between APR and APY?

APR (Annual Percentage Rate) doesn’t include compounding, while APY (Annual Percentage Yield) does. Our calculator uses APY for more accurate growth projections.

Compound Interest Strategies

1. Start Early

A 25-year-old investing $300/month at 7% can accumulate $1 million by age 65. Waiting just 10 years means you’d need to invest more than double to reach the same goal.

2. Automate Contributions

Set up automatic transfers to take advantage of dollar-cost averaging and reduce emotional investing. Automation keeps you on track without needing to think about it.

3. Reinvest Dividends

Using a Dividend Reinvestment Plan (DRIP) adds to your total shares and compounds returns faster, especially useful in retirement accounts like IRAs and 401(k)s.

Limitations to Consider

While compound interest is powerful, remember:

Market volatility can affect actual returns

Taxes may reduce your earnings (use our tax field for clarity)

Inflation erodes purchasing power over time

Conclusion

Compound interest is one of the most powerful forces in wealth creation. Use our free calculator to visualize your financial future and take control of your money. Whether you’re saving for retirement, a big purchase, or just building a cushion, small consistent actions today lead to life-changing results tomorrow.

📌 Bookmark this page to track your progress or share it with friends who are building their wealth too!